When you bank with OTIS, you can bank on OTIS.

Whether you’re opening your first account, getting married, or ready to retire, OTIS has the financial products and services that you need – and the competitive rates you’re looking for. Join OTIS FCU today and experience the OTIS Advantage!

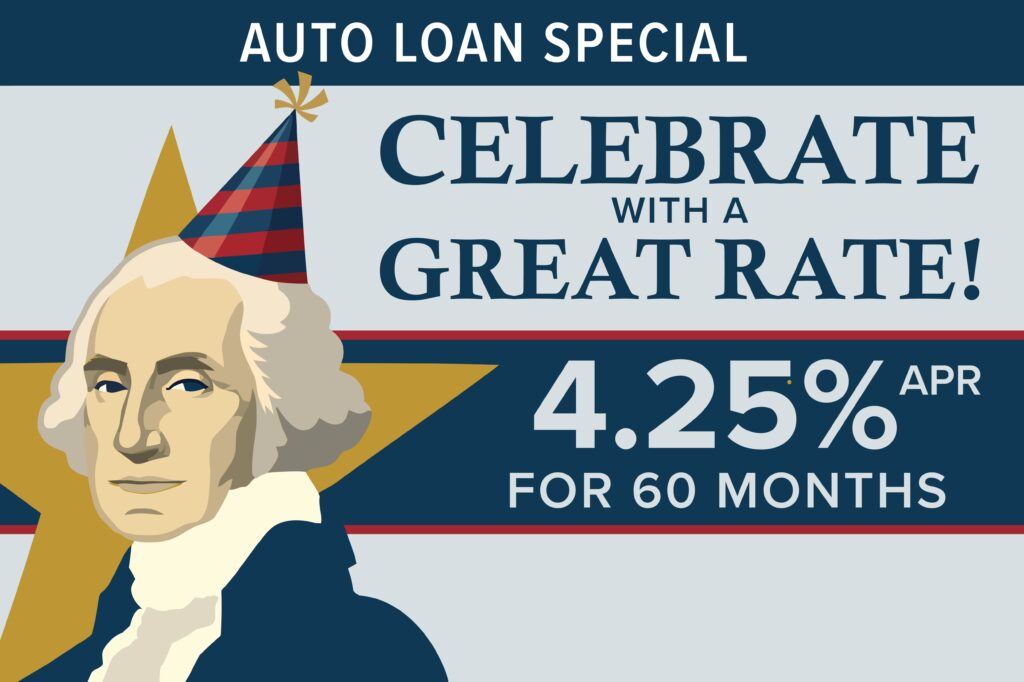

Washington’s Birthday Auto Loan Special!

Affordable financing is always a reason to celebrate! Finance your auto loan with OTIS and experience rates as low as 4.25% APR* for 60 months!

*APR = Annual Percentage Rate. Promotion effective February 9-March 13, 2026. Promotional rate advertised is for a 60-month term at 4.25% APR for a credit score of 730 or higher. Offer is subject to change without notice. Loan rate is determined by your personal creditworthiness. Credit approval required. Minimum loan amount is $5,000. Existing OTIS FCU loans do not qualify for this offer. Member eligibility required. Federally Insured by NCUA. Equal Housing Lender.

Latest news

We’re here for you.

In the neighborhood? Stop in 9 AM to 5 PM, Monday through Friday. We’re committed to service with a smile!

Applying for a loan? To ensure you are helped in a timely manner during our renovation, please call to schedule an appointment with our lending team, or conveniently apply online!